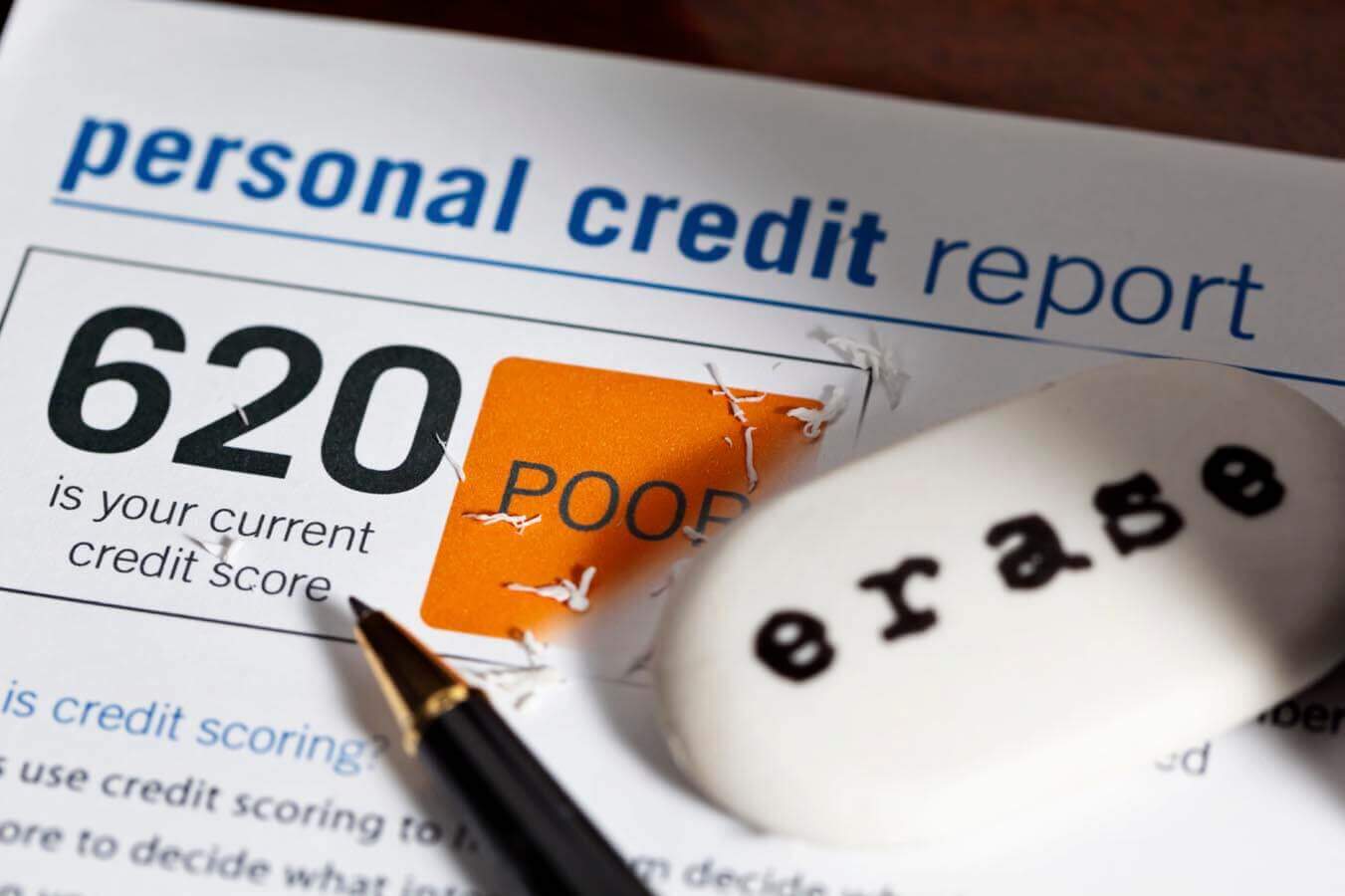

Comprehending Just How Debt Repair Works to Improve Your Financial Health

The procedure includes identifying errors in credit scores records, disputing errors with credit history bureaus, and negotiating with lenders to address exceptional financial debts. The question continues to be: what specific methods can people employ to not only fix their credit report standing yet also make sure long-term financial stability?

What Is Debt Repair Work?

Credit repair work refers to the procedure of boosting an individual's creditworthiness by resolving errors on their credit scores report, discussing financial debts, and taking on better financial practices. This diverse technique intends to boost an individual's credit score, which is a vital aspect in safeguarding lendings, credit report cards, and positive rates of interest.

The debt fixing procedure commonly starts with a detailed testimonial of the person's debt record, enabling for the identification of any type of errors or discrepancies. As soon as errors are identified, the private or a credit score repair service expert can initiate disputes with credit rating bureaus to rectify these concerns. Furthermore, negotiating with lenders to work out superior financial obligations can even more improve one's economic standing.

Additionally, taking on sensible financial techniques, such as prompt bill repayments, decreasing credit application, and preserving a varied credit report mix, contributes to a much healthier credit scores account. In general, credit fixing functions as a necessary strategy for individuals seeking to reclaim control over their monetary wellness and secure much better loaning opportunities in the future - Credit Repair. By participating in credit repair work, people can lead the way toward accomplishing their monetary objectives and boosting their overall lifestyle

Common Debt Report Mistakes

Mistakes on credit report records can significantly impact a person's credit history, making it crucial to comprehend the typical sorts of errors that might occur. One common concern is inaccurate personal details, such as misspelled names, incorrect addresses, or wrong Social Safety numbers. These mistakes can cause complication and misreporting of creditworthiness.

An additional typical mistake is the coverage of accounts that do not belong to the person, often because of identity burglary or clerical errors. This misallocation can unjustly lower a person's credit report. In addition, late payments might be wrongly recorded, which can occur because of payment processing errors or inaccurate reporting by lending institutions.

Credit line and account balances can also be misstated, leading to a distorted view of a person's credit application proportion. In addition, outdated info, such as shut accounts still appearing as energetic, can adversely influence credit report evaluations. Public documents, including personal bankruptcies or tax liens, might be erroneously reported or misclassified. Understanding of these typical mistakes is crucial for reliable credit score management and repair, as addressing them promptly can assist individuals maintain a healthier monetary account.

Steps to Conflict Inaccuracies

Challenging inaccuracies on a debt report is a critical process that can assist recover a person's creditworthiness. The first action involves acquiring a current copy of your credit history record from all three major credit score bureaus: Experian, TransUnion, and Equifax. Testimonial the record meticulously to identify any type of mistakes, such as inaccurate account details, balances, or repayment histories.

As soon as you have determined disparities, gather supporting paperwork that substantiates your cases. This may consist of bank statements, payment confirmations, or correspondence with creditors. Next off, launch the dispute process by speaking to the pertinent credit bureau. You can generally submit conflicts online, using mail, or by phone. When submitting your disagreement, plainly outline the errors, offer your evidence, and include individual recognition info.

After the dispute is submitted, the debt bureau will certainly investigate the case, usually within 30 days. Maintaining precise records throughout this process is vital for reliable resolution and tracking your credit score wellness.

Structure a Solid Credit Scores Profile

Developing a strong credit rating account is necessary for safeguarding favorable monetary opportunities. Continually paying credit rating card bills, car loans, and various other responsibilities on time is important, as repayment history significantly affects credit rating scores.

Additionally, keeping reduced debt usage proportions-- ideally under 30%-- is essential. This implies maintaining bank card equilibriums well listed below their restrictions. Branching out credit report kinds, such as a mix of revolving credit rating (charge card) and installation lendings go now (auto or mortgage), can additionally enhance credit history accounts.

Frequently checking debt records for inaccuracies is just as vital. People should assess their debt reports at the very least each year to recognize disparities and contest any mistakes promptly. In addition, avoiding extreme credit rating questions can protect against possible adverse influence on credit rating.

Long-lasting Advantages of Credit Score Repair

Furthermore, a stronger debt profile can promote much better terms for insurance premiums and even influence rental applications, making it much easier to safeguard real estate. The emotional benefits need to not be ignored; people that efficiently fix their debt usually experience decreased anxiety and boosted confidence in managing their financial resources.

Final Thought

In conclusion, credit score repair work serves as a vital system for improving financial health and wellness. By recognizing and disputing errors in credit history reports, people can rectify mistakes that negatively influence their credit history ratings.

The long-lasting advantages of credit fixing extend much beyond just go to these guys boosted credit report scores; they can dramatically improve a person's general financial health and wellness.